Risk Management And Profitability In Banking

Introduction

Banks tend to be one of the largest institutions across globe, which deal in finances. In the current era there are different types of banks available, providing different types of commercial services. The most common type of bank is the commercial bank which is involved in the day to day business activities with the individuals & corporate across the globe. Since their dealing is in daily finances, they are further subjected to a number of regulations. One of the many regulations is the requirement of the minimum capital by the banking organisations which must be kept for absorption of loss in case any adverse event happens (Coles, 2020).

The financial liberalization and elevation in the level of business and competition among the financial institutions for gaining market share has further made risk analysis an imperative part.The term risk management in the purview of banking does not imply that banks are not allowed to take risks. It rather sets regulations and safeguarded measures under the purview of risk, as much as the capital structure of the given banking institution might allow at the given point of time(Yaylali & Safakli, 2015).

Understanding Risk Management

Need of risk management in the financial sector has been quite a significant part. Furthermore with the Based II Accord, risk management has further seeped into being a core part n the banking sector. The financial liberalization and further elevation in the level of business and competition among the financial institutions for gaining market share has further made risk analysis an imperative part. There has been further expansion in the credit derivative market as well as there have been newer financial instruments dealt by banks for the changing business scenarios. The credit management has gone to become further complicated in past two decades. A result of these developments in the banking and financial sector, the introduction of risk evaluation has been quite a necessity(Bhati, S. et al, 2020).

Source: (Coles, 2020)

The first major step in the effective risk management process is the identification of the exposures of risks to which a business might be subjected to. The subsequent steps then include the measurement of extent of these financial risks and finally the control and mitigation measures which can be deployed under the purview controlling these risks. At the stage of control university assignment help said mitigation of risk various regulations set under the purview of BASEL Accord take hold. A number of regulations are further taken into account (Zubairi & Ahson, 2015).

Purpose Of Risk Management In Banking Sector

The term risk management in the purview of banking does not imply that banks are not allowed to take risks. It rather sets regulations and safeguarded measures under the purview of risk, as much as the capital structure of the given banking institution might allow at the given point of time. Banking as nature of business itself deals with numerous risks and avoidance of risks at all would rather result in incurring losses under the purview of these establishments. Thus, main objectives of risk management under the sector of banking include improvement in the overall financial performance of the banks, and preventing the banks form incurring any major loss which it may not be able to accept or cover through its own capital(Srestha, 2017).

A banking business mostly requires a well organized and sustainable system of risk management which can further be adapted to various conditions as per the changing market situations, while also being in compliance with the bank’s structure at the same time along with the employment of its inactive capital into a yielding financial activity. The types of risks borne by the banking business have been expanding with changing financial instruments and changing business scenarios as well(Hallunovi & Berdo, 2018).

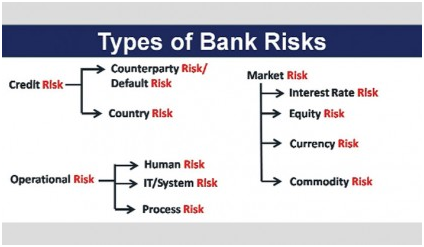

Common Risks Factors In Banking

Banks tend to invest in securities as all the market levels, thus there tend to be a variety of risks which they deal with on a day to day basis. These numerous risk can be condensed into two major categories of risks under the purview of a banking business. The following are two main categories:

Market Risks: The market risks under the purview of a banking organisation are also the macro level risks which they deal in. These are unavoidable in nature, and thus can be a major cause of concern for the banking institutions. The market risks are defined as the risks of losses which occur due to changes in market scenarios of loss of variables in a market. The variables under this purview include changes in rate of exchange, changes in the interest rate risks and changes in the inflationary levels in an economy.

Credit Risk Factors: The external risks on the other hand include the credit risks which primarily tend to occur when the bank tends to take up a role of intermediary on the over the counter trade transactions. In case the counter party in such trade fails to honor its part of payment, the negative side of such risk comes to its play. In a day to day banking business, if a client fails to make interest payment or defaults in the payment of principle amount, the banks may have to bear serious repercussions. Under this purview derived by instant assignment help experts ,the management risks is the key takeaway in this business sector(CFI, 2021).

Operational Risk: these arise from within the institute, and usually tend to be controllable in nature.

Elements In A Sound Risk Management Process

The major elements under the purview of risk management tend to depend on situation of risk which is being dealt in. Since, each situation under the purview of risk can be unique; the risk management fundamentals tend to be adjustable as a case per case basis. The complexity as well as formality tends to vary widely amongst the institutions, each institution under this purview tends to create an assessment procedure for each risk that the organisation deal in, it further helps in evaluation of the performance over time as well.

Source: (Deloach, 2018)

The major elements include the level of accountability, separation of duties as well as clear lines of the authority under the purview of organisational management. The duties of those particularly involved in the purview of management of risk as well as internal control of the banking institution form the major element of this overall process. These elements, along with other time tested elements are involved in the risk management techniques of the organisation.

Process Of Risk Management

The process of risk management involves several stages which must be encountered by a banking institution in to present an analysed reporting of the overall determined risks which are evaluated by the use of appropriate methods of risk measurement. Under this process the regulatory as well as supervisory authorities set up methods of measurements of risk, which the institution might be exposed to in its daily course of business. Once the appropriate risks have been identified, the risk exposures of the business properly need to be recorded. These recorded risks are further formed into risk policies under the purview of the business, which are implemented by the senior management(Acevedo, 2020).

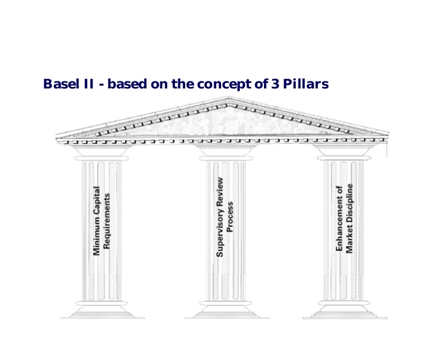

Risk Management In Banks & BASEL Accords

As per the Basel II accord, the banks must function under three major pillars. These pillars are formed keeping the major market risks in focus, which are projected to a bank. Cheap essay help writers of ArabEssay derived to ensure that banks are able to manage their risks, the three pillars laid under this accord include:

- Capital adequacy requirements

- Supervisory review

- Market discipline

The pillar of capital adequacy approach requires for standardised approach as well as internal ratings based approach for the organisation. The method of ‘risk-weighted assets’ is deployed which lays provisions for banks to maintain a minimum level of capital adequacy ratio. Under the standardised approach,banks deploy use of ratings from external sources including credit assessment institutions, for internal approach, banks deploy methods to calculate the probability of default in case of a bank’s debtor (Princeton, 2021).

The other pillar allocates for supervisory review. The supervisory review lays to effective supervision in internal capital adequacy of a bank and a need for the capital structure under the purview of the bank. Supervision is meant to ensure appropriate allocation of capital and intervention at decision making process to ensure appropriate risk levels (Okarimia, 2016). Get to know more about banking supervision from online assignment help experts of ArabEssay.

And finally the pillar of market discipline implies to evaluate the market risks and disclosure of essential market information under the purview of placement of the capital.Furthermore, Basel III Accord has come into purview, providing further revised definitions and techniques of risk management under the purview of banking institutions (Onyiriuba, 2016).

Risk Management And Capital Adequacy

The term ‘capital adequacy’ in an organisation reflects the statutory level of minimum capital reserve which might be needed by a financial institution or investment firm, or the banking institution, to have this available is a minimum level of required capital under the purview of risk weighed assets as well as current liabilities under the purview of the business. In other words, capital adequacy ratio, abbreviated as CAR tends to measure the amount of capital a bank must retain in comparison to the risk taken up by the bank. There are two types of CAR under the purview; the tier 1 CAR persists ensuring that institution can absorb a reasonable amount of loss without any failure to cease its trading, while the tier 2 represents the situations when institution can sustain loss in event of the liquidation. Thus tier 2 presents less protection to depositors as against the tier 1(Maverick, 2018 ).

Even though banks operating under the excessive capital in hand do not present much of problems in terms of risk, it can be problematic for the investors. Assignment writer made a remark on A capital lying idle with the bank is actually a deal of loss for the business. This further results in in a reduced equity and less profitability to banks than it can actually earn(Bhati, S. et al, 2020).

The relationship with risk management to that of capital adequacy is that the potential of risk must be taken in the proportion of capital available with the bank. However, if the larger part of capital is kept idle it would result in reduced profitability and low return on equity. But at the same time, the level of economic capital in bank must be adequate enough to meet the level and amount of losses. Given the point of time, there is also a need to distinguish between the unexpected losses and the expected losses. The part of capital which must cover the unexpected losses arising from the risk is called a venture capital. The capital adequacy ratio in a bank signifies if the credit rating is high, the probability of the bankruptcy of the institution becomes largely low (Yaylali & Safakli, 2015).

Risk Management & Profitability In Banking

Banks tend to be one of the largest institutions across globe, which deal in finances. In the current era there are different types of banks available, providing different types of commercial services. The most common type of bank is the commercial bank which is involved in the day to day business activities with the individuals & corporate across the globe. Since their dealing is in daily finances, they are further subjected to a number of regulations. One of the many regulations is the requirement of the minimum capital by the banking organisations which must be kept for absorption of loss in case any adverse event happens(Maverick, 2018 ).

Going back in history of banking, in the decade of 1970, some disruptions in banking occurred; which ended up affecting the international financial markets. Then, the Supervisory office of the German Federal Banking ended up withdrawing the license of Bankhaus Hersatt, and due to unsettled trade with Bankhaus Hersatt, banks outside Germany had to take up deep losses. Around the same time, New York’s Franklin National Bank also shut it door owing to huge foreign exchange losses. A number of other small localised banking events were also registered, which further led to contributing to the banking regulations reforms under BASEL committee, beginning with central banks of G10 nations(Li & Zou, 2015).

But this did not end the bank & financial disruptions in the coming decades. Latin American debt crisis in the 1980 particularly caught attention of the Basel committee. Further Asian Financial crisis of 1997 and most prominent global financial crisis of 2008 witnessed some stark crash and failure in the banking systems. As per dissertation help professional Creating a domino effect and interconnections of banks due to international trade ended up resulting in global level bank crisis (Okarimia, 2016).

Profitability Of Commercial Banks

The terms profitability under the purview of banking indicates its capacity to be able to either carry risk or increase their capital, indicating their measure of management and competitiveness in the sector. There are internal and external control leading to its profitability and methods like DuPoint Model, return on equity and return on assets help in analyzing the profitability under the purview of the business(Yaylali & Safakli, 2015).

CAR & ROE

Under the purview of study it can be understood that capital adequacy ratio (CAR) plays a significant role in the risk management. However there is not direct affect of it linking to the return on equity (ROE). Rightlythough the idle capital kept under the purview of CAR generates no profits, but given the major risk bearing events under the purview of banks, it cannot be denied that it tends to provide as a major cushion in the case of events leading to losses. So, in the simplest form, it can be ascertained that risk management may not have a contribution in direct profitability of the banks, it definitely does contribute in prevention of losses, or provides as cover from losses that occur due to interconnected or international financial events(Yaylali & Safakli, 2015). At last, if you have any doubt in regards of financial events, take assistance from plagiarism free assignment help of ArabEssay.

Conclusion

The above study has aimed at discovering the relation between the risk management procedure and subsequent affect of profitability in a banking institution.

The study has established that credit management has been becoming quite complicated in recent decades and risk management has become an imperative part of financial institutions to deal with several credit, market and operational risks. The BASEL accord and its provisions which were developed seeing numerous bank crises particularly in the decades of 1970 and 1980 tend to provide some regulations to take a blow in case of occurrence of risk.

In this purview keeping a capital adequacy ratio may lead to some idle capital which tends to lower the return on equity. However, it has been established that risk management may not have a contribution in direct profitability of the banks, it definitely does contribute in prevention of losses, or provides as cover from losses that occur due to interconnected or international financial events.

References

Acevedo, L. (2020). Risk Management Techniques. Retrieved from https://smallbusiness.chron.com/design-audit-policy-plan-18449.html

Azad, S. (2018). Operational Risk: Banking Perspective. Retrieved from https://www.daily-sun.com/arcprint/details/338633/Operational-Risk:-Banking-Perspective/2018-09-26

Bhati, S. et al. (2020). IMPACT OF RISK MANAGEMENT ON PROFITABILITY OF BANKS. Malaysian E Commerce Journal .

CFI. (2021). Managing Risks in Investment Banking. Retrieved from https://corporatefinanceinstitute.com/resources/knowledge/strategy/managing-risks-in-investment-banking/

Coles, D. (2020). How to identify, analyse and manage the risks your business faces. Retrieved from https://www.dandmmanagementaccountants.co.uk/risk-management

Deloach, J. (2018). Key Elements of the Risk Management Process. Retrieved from https://www.corporatecomplianceinsights.com/key-elements-of-the-risk-management-process/

Hallunovi, A., & Berdo, M. (2018). The Relationship between Risk Management and Profitability of Commercial Banks in Albania. Asian Themes in Social Sciences Research .

Li, F., & Zou, Y. (2015). The Impact of Credit Risk Management on Profitability of Commercial Banks: A Study of Europe. Retrieved from http://www.diva-portal.org/smash/get/diva2:743402/FULLTEXT01.pdf

Maverick, J. (2018 ). Why Is the Capital Adequacy Ratio Important to Shareholders? Retrieved from https://www.investopedia.com/ask/answers/042915/why-capital-adequacy-ratio-important-shareholders.asp

Okarimia, J. (2016). James Okarimia – Basel II Pillar1 Analytics : Covering Credit, Market,and Operational Risks. Retrieved from https://www.slideshare.net/JAMESOKARIMIA/james-okarimia-basel-ii-pillar1-analytics-covering-credit-marketand-operational-risks

Onyiriuba, L. (2016). Applications of Basel Accords in Emerging Economies. Emerging Market Bank Lending and Credit Risk Control .

Princeton. (2021). Basel II. Retrieved from https://www.princeton.edu/~markus/teaching/Eco467/10Lecture/Basel2_last.pdf

Srestha, R. (2017). The Impact of Credit Risk Management on Profitability: Evidence from Nepalese Commercial Banks. SSRN Open Journal .

Yaylali, P., & Safakli, O. (2015). Risk Management in the Banking Sector: Case of TRNC. International Journal of Academic Research in Economics and Management Sciences .

Zubairi, H., & Ahson, S. (2015). BALANCING RISK MANAGEMENT AND PROFITABILITY. PAKISTAN BUSINESS REVIEW JULY .